What is actually FDIC Insurance rates and you can Exactly what are the Coverage Limits?

Visibility are automatic when you open one form of profile at the an FDIC-covered bank. When you’re in one of the 5.9 million You.S. homes rather than a bank checking account, and you are clearly seeking discover an account, FDIC provides tips to help get you started. Even though the the newest rule usually offer insurance coverage for most believe citizens, it could remove publicity when you yourself have placed over $1.twenty-five million for each holder within the believe account from the you to insured establishment. Thus, i strongly recommend which you take time to review their trust accounts as well as your faith and you will property thought documents to understand how you will getting impacted. If you feel the new laws can get feeling you, delight contact us to discuss your specific problem much more breadth.

Explore IntraFi Community Dumps

If your workplace does not render a good P60, you can utilize the brand new HM Cash & Culture software to obtain the exact same suggestions. An excellent P60 shows how much income tax you have got paid-in the newest government’s economic year, and this works out of 6 April to 5 April. For those getting ready to spray from on holiday, i rounded in the study wandering charges getting billed from the UK’s biggest cell phone organization. It is really not clear who’ll enjoy the U-turn – all of the we all know is more pensioners was eligible and you can an enthusiastic statement might possibly be made in the brand new fall.

June Online game Conference Plan 2025: All Show And the ways to Check out

A negotiable Buy from Withdrawal (NOW) account is actually a discount deposit–maybe not a consult put membership. Unincorporated associations normally covered lower than these kinds tend to mr.bet blackjack be churches or any other religious communities, people and you can civic groups and personal nightclubs. The fresh FDIC takes on that most co-owners’ offers is equivalent except if the new put membership information condition otherwise.

Of numerous brokerages supply Dvds from other banks all over the country, so it’s an easy task to stay in this FDIC constraints when you’re possibly making finest rates. You need to be conscious your’re also guilty of making certain that your bank account is actually spread out certainly on their own chartered banks to optimize your own FDIC insurance coverage. Bank problems is impractical, nevertheless they manage happens. FDIC deposit insurance rates handles your covered dumps should your bank closes.

Next, such times might be placed under occasional half a dozen-day call-up to ensure that DCMWC could have been advised of all case/fee alter. Just before January step 1, 1957, the key benefits of the new FECA had been expanded lower than specific things to help you reservists of one’s army and their beneficiaries where the burns or death of the brand new reservist took place distinctive line of duty if you are to the energetic obligations. Personal Law , approved August step 1, 1956, terminated the brand new FECA entitlement to the persons energetic January 1, 1957. A story page should also getting authored to your claimant, having a copy to the DVA, describing the fresh costs, write-offs, or type of recuperation out of twin payments.

Don’t fret, even though, as the second-most-bottom line to know about FDIC coverage is that you could be covered for much more, according to where you keep your account and just how he is owned. One method to make certain that all cash is insured is to pass on they across the numerous establishments. Your immediately rating insurance coverage to the brand new $250,100000 limit after you unlock a merchant account at the a lender one’s FDIC covered. Learn how to guarantee more than $250,100000. Banking institutions are not covered automagically.

Just what it methods to has FDIC insurance rates

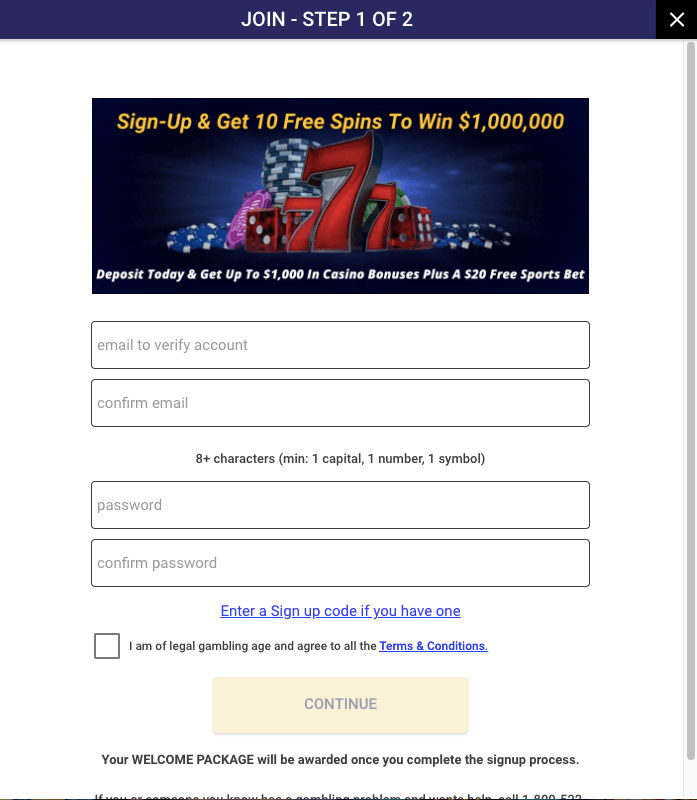

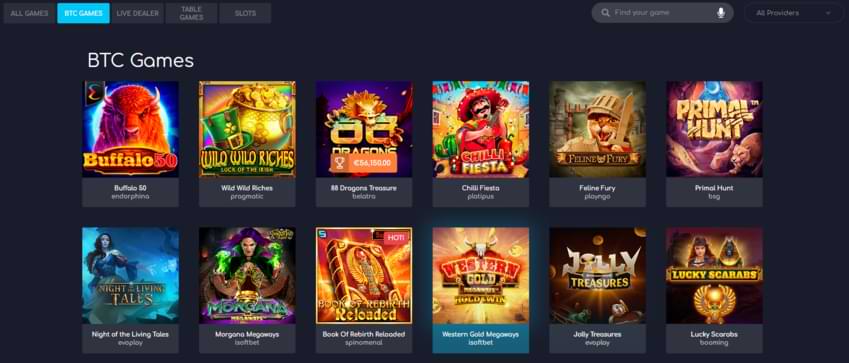

Users play by playing games from opportunity, occasionally that have an element of experience, such craps, roulette, baccarat, blackjack, and electronic poker. Really games provides statistically computed chance you to make sure the house have at all times a bonus along side participants. This can be expressed far more accurately by the concept of requested worth, that is uniformly bad (on the player’s angle). So it advantage is called our home line. Inside the game such casino poker in which professionals enjoy up against both, our home takes a commission called the rake. Casinos both share with you free things or comps to bettors.

- The new T&We dumps are covered for the a “pass-through” base for the individuals.

- Yet not, in practice, money in the impairment claims have been according to the each week price.

- Sometimes it is identified as lots of months from shell out, and other minutes since the a certain number of money, depending on the law governing the new department under consideration.

- Of several brokerages provide Cds out of various other banking companies across the country, making it easy to stay in this FDIC constraints when you’re probably getting best cost.

- The new brokered category grounds these deposits to receive higher analysis away from government while in the financial evaluation symptoms and you may exposes the institution to raised FDIC insurance costs.

Name Of Obligations Seasons cuatro – All The fresh Black Ops 6 Multiplayer Maps, As well as Fan-Favorite Remaster

Within the hardly any most other circumstances could it be required or desirable to generate a choice out of long lasting and you may complete disability. Such a choice confers no additional benefit to your claimant, and it you could end up forfeiture of most other rights one an excellent claimant get have lower than most other Government laws and regulations. Hence, it’s always sufficient to remain repayments for temporary complete handicap (TTD), also where perform to reemploy and you may/otherwise rehabilitate the new claimant have failed.

So, someone whose account meet or exceed the newest limitation at the one establishment may wish to move one or more account to another establishments so you can enhance their FDIC publicity. Today, there is certainly one trust account category detailed with each other revocable and irrevocable trusts, and you can a rely on holder features one to $1.25 million insurance policies limitation for the trusts. The overall code one to a confidence membership get $250,100 from coverage per recipient are unchanged. A rely on account which have one holder (the fresh trustee) and you will three beneficiaries are covered to possess $750,000. The most important thing to possess membership owners to remember you to definitely its put offer are for the hit a brick wall bank which is experienced gap abreast of the newest inability of one’s financial. The new getting organization has no obligations to keep up both the newest hit a brick wall bank costs or regards to the brand new membership agreement.